How Will Budget 2022 – Property Tax Increment Impact The Housing Market?

Kumar Properties

How Will Budget 2022 – Property Tax Increment impact the housing market?

Budget 2022 – Tax rates for Residential Properties will be raised, this was announced by Singapore Government Finance Minister Lawrence Wong on 18 Feb 2022. They want to increment in two steps, starting with the Tax payable in 2023, with Singapore real estate properties at the higher end seeing steeper hikes.

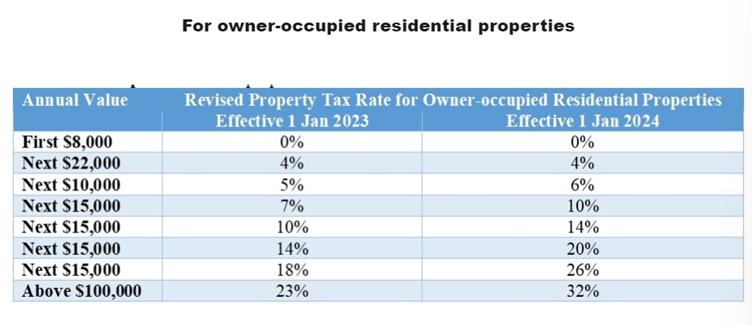

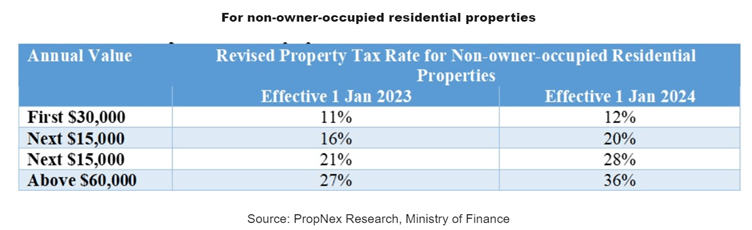

The property tax rates for owner- occupied Singapore properties for the segment of yearly value more than $30,000 will be raised from 4% to 16% presently, 6% to 32%. And tax rates for non-owner-occupied residential Singapore properties, will increase from 10% to 20% currently, to 12% to 36%.

Impact on Owner-Occupied Properties

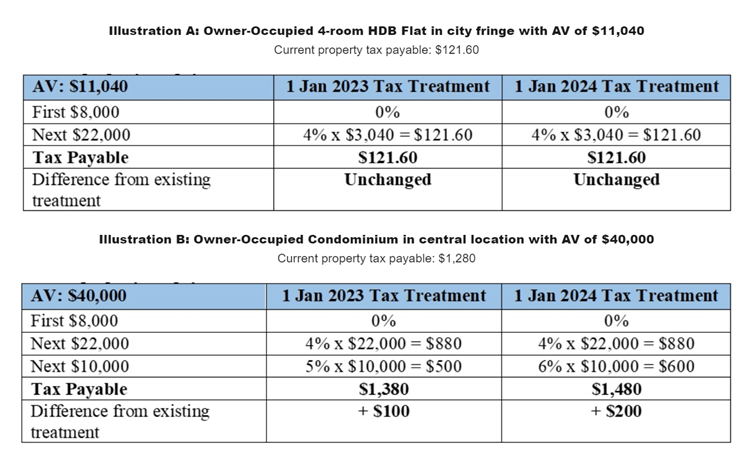

For example, there is a 4 bedroom HDB flat in city fringe with an annual value (AV) of $11,040 will continue to pay $121.60 in Singapore property tax – even with the tax payable under existing tax treatment. Further example about an owner- occupied condo in central location with an annual value of $40,000 will be a final tax raise of $200 in 2024 as the real estate property tax payable increase from the current $1,280 to 1,480. ( See Illustration B)

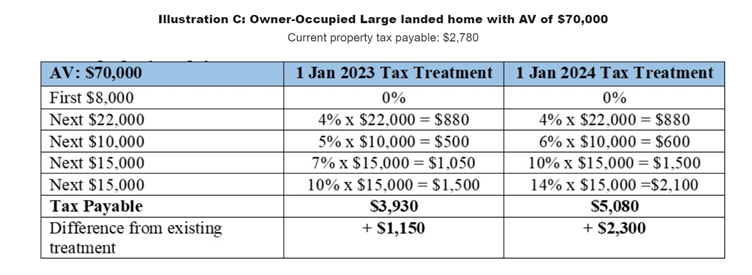

Eventually, a property owner who is living in a large sized landed Singapore property will have to fork out more on property tax after the revision, with tax payable increasing from the current $2,780 to $3,930 in 2023 and to $5,080 in 2024 (See Illustration C).

Most of the householders need to manage the raise in Singapore property tax on owner-occupied homes. However, a certain people find difficult to bear property tax hike like retire people who are living in a extra size landed property and don’t have a lot of savings amount.

Impact on Non-Owner-Occupied Properties

Meanwhile there is a non-occupied condo in the suburbs with an annual value of $30,000 will be a raise of $600 in Singapore property tax payable to $3,600 from 2024 (See Illustration E).

We believe mostly the future Singapore property tax rates are not seriously decrease buying interest nor affect the residential market significantly. Most of the Singapore real estate property investors investing Singapore properties take a longer-term view on property purchases, focusing on the long-term returns, capital growth potential and to preserve their wealth – rather than looking at the holding cost in the form of property tax.

Any Singapore property tax or cooling measures arrive, they won’t affect buyer’s interest or won’t stop people to invest in properties. Additionally, Singapore remains attractive investment destination for most of the people, with currency and political environment.

We will provide different articles about current market situations and what things you should do for property investment. Follow us and contact us for more information.

GET IN TOUCH

We will love to answer any queries you might have. Submit this form and we will be in touch with you shortly.

For Free Consultation. Kindly Contact Our Team At +6569028874.

KUMAR PROPERTIES

Find Your Dream Home

SITELINKS

Kumar Properties

About Kumar

Services

Client Testimonials

Mortgage Calculator

Valuation

Recent Comments