Are You Ready To Buy A Property? Read This First.

Kumar Properties

Are You Ready To Buy A Property? Read This First.

Buying property instinctly, is seldom a good idea. And for a major expense like a property, entering the market without doing in-depth research and analysis is extremely not sensible. May seems to have a good investment opportunity, but it is not good to advise to go in blind, to speak. In fact, if it seems to be good is true, it warrants for a closer look.

So, What we do? Before commencing on house hunting, consider it, why should I buy this property? It is simple to hear, but it is good to have a clear-mind about why you enter into the property market. For instance, are you planning to move yourself, is your intention to rent it out, do you want own an existing property. What do you want to do with it? If your intension is to hold on your existing property, you have to pay the additional buyer’s stamp duty (ABSD) for your second property purchase.

/Blog%2028%20JAN%202021_2%20lr.jpeg)

Be practical, be wise

Next step, is to decide what is your budget – what you can afford to buy property and what would do if it extends the limit? Proper financial planning and develop a financial safety net is absolutely not possible because properties cannot be sold quickly and make cash when you are in a blind. If you fall on hard times and want to sell or rent your unit, then certainly your are not sure to fetch an attractive price/rent.

Be wise, If you think you can afford with a comfortable amount of $1.2 million condo, and don’t want to max out that the budget, because we have consider the other expenses, which includes the ABSD for the second property buy, legal fees etc.

Key concepts when estimating property buying opportunities

So, you have decided with your property investment objective, estimated your financial position, and considered the possibility of using leverage, next what? Coming to research and analysis.

There are three important criteria in estimating property investment opportunities. It is important that each of the three factors are considered how they could impact the property’s rent ability and capital growth potential in the future.

1.Location

In real estate, location is very important. Location influences the worth to buy property, and the worth helps to boost demand of the property. Higher the demand, higher the price.

The main factors to consider when it comes to location:

- Central or outskirts: Is the property available in the city, at a city fringe or in the suburbs.

- Transportation and accessibility: How far is the distance from property to an MRT station also consider the bus interchange and bus stop? And the ease of access to main roads and the expressway.

- Neighbourhood: The facilities and amenities available around the property? Like shops, food places, supermarkets and recreation facilities such as parks or sports hall.

- Schools: The schools available in the nearby area. ( When there are more applicants than vacancies, the admission priority will be given based on child’s citizenship and the home-to-school distance)

- Lot/Unit Location: Is the unit available in the high floor. Does the unit face main road, pool or a park.

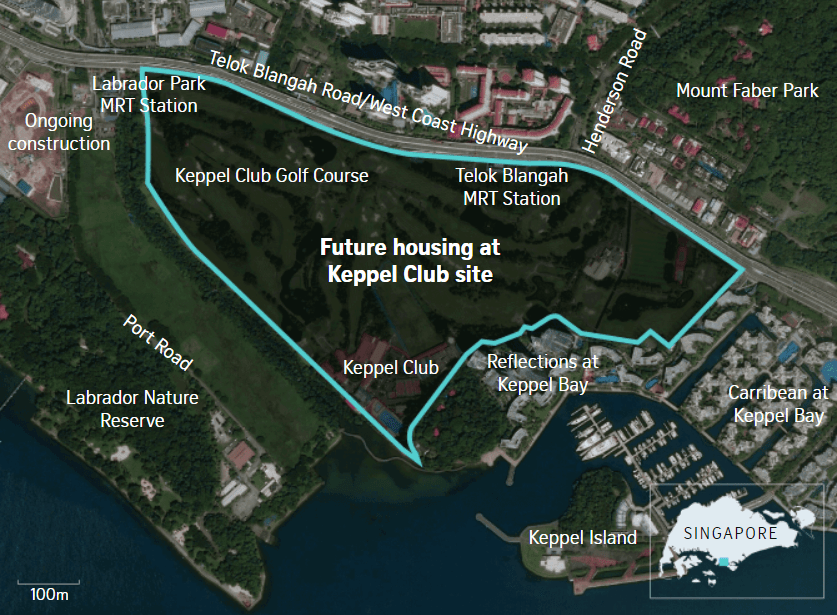

- Mature or non-mature estate: Is there any other development sites, which means more supply of units and potential competition for buyers and tenants when you are planning to sell or lease your units in the future.

2.Entry Price

Here we consider whether you buy a property at a market price, below market value or you are overpaying compared to the nearby surrounding properties? If you overpaid for a property your capital gain in the future may be low or even nil – unless the property market significantly for over a period of time.

So assess your entry price with the recently transacted prices of comparable properties in the nearby areas, as well as recent transactions in the same development unit. Make an assessment that prices or rents of properties are climbing over the last few years and whether the prices have gone upto the mark since the project was launched.

Then looking at a new launch project, consider the stage of the launch. Developer offers starbuys in the initial stage of launch to get sales momentum going. If you want to buy at a later stage where the developer has already sold more than 70% of the units in the development, then you have to end up paying slightly more.

3.Urban transformation

The Urban Redevelopment Authority’s Master Plan, which is a permitted land use plan that conveys Singapore’s development over the next 10 to 15 years. It shows the development densities, permissible land use, and urban transformation plans in Singapore.

Before shortlisting the potential properties to invest in, make sure to consult the master plan on what are the development plans for the area. These all will likely have a positive impact on capital values for the long-term.

The property investment may carry some form of risks, but considering the necessary site and price estimation and proper financial planning, you are likely to get a smooth investment experience.

GET IN TOUCH

We will love to answer any queries you might have. Submit this form and we will be in touch with you shortly.

For Free Consultation. Kindly Contact Our Team At +6569028874.

KUMAR PROPERTIES

Find Your Dream Home

SITELINKS

Kumar Properties

About Kumar

Services

Client Testimonials

Mortgage Calculator

Valuation

Recent Comments