How to Upgrade from HDB Flat to Private Property?

Kumar Properties

How to Upgrade from HDB Flat to Private Property?

In Singapore, almost 80% of the people have HDB flats. Their main aim is to buy better private property. If you have bought your first HDB flat with an easy process, they upgrading HDB flat is simple. But upgrading from an HDB flat to private property is much harder than buying first HDB flat.

Why Buying HDB Flat is Much Easier Than Upgrading From HDB to Private Property?

When you buy your first property, you will be having main concern about the minimum paying downpayment and you will be thinking about whether you will qualify for an HDB/ bank loan. If you want to choose an HDB loan, the minimum downpayment required is 10% and for a Bank loan, the minimum downpayment required is 25% and 5% should be cash. Because of this reason, many of HDB buyers prefer HDB loan instead of Bank loan eventhough interest rate of bank loans are higher.

When upgrading from HDB flat to private property, steps will be much more complex. If you are careless while processing, there will be much more chances of getting something wrong. Still for upgrading HDB to private property is a double process, first you need to sell your HDB flat then you need to buy property.

So for upgrading HDB flat to private condo consulting property agent is the best idea to make process in smooth way. The property agent will guide in every step of selling and buying process of property. You will be having stress process for upgrading your property.

Do You Want to Sell Your HDB Flat Before Buying a Private Property?

If you want to upgrade from HDB flat to private condo, my suggestion is to first sell your HDB flat then plan for a condo. By selling your HDB flat you will receive some amount of money and you can analyse which property you can afford. Then you can afford better property than you think. Secondly, if you sell your existing hdb flat within 6 months you can avoid 12% of ABSD (Additional Buyer Stamp Duty). Selling your HDB flat in a hurry to get ABSD remission is the last thing you want to happen, as this may result in accepting a lower offer than you wanted.

For instance, if you want to buying other private property, price of that condo is $1 million you need to pay 12% of ABSD that means you need to pay $120,000. If you have not sold your HDB flat upon exercising the option to purchase the private property.

Steps to Upgrading from HDB flat to Private Property

Step 1: Making decision to sell your HDB flat:

If you decided to sell property, engaging with property agent is the best thing to complete selling process easy. Before giving your property for marketing make sure to discuss about the commission fee and exclusive agreement with the real estate agent.

One of the best agent for selling property or upgrading your property is Kumar. He will help you to sell your property above market value and also give suggestions for next purchase of your property. First you need to register your intent to sell for your HDB flat. You can only grant an Option-To-Purchase (OTP) to buyers at least 7 days after registering your intent to sell. Depending on the location, demand on your property it takes time to sell your property.

Step 2: Issuing An Option-To-Purchase (OTP), Receiving The Option Fee & Exercise Fee

If you market your HDB flat and you will be receiving so many offers from the buyers. You should choose potential buyer who can offer more money to buy your HDB. To grant the OTP for an HDB flat, the potential buyer needs to pay an option fee of between $1 to $1,000. This is unlike buying a private property when the option fee is usually at least 1% of the mutually agreed price.

In the case of a poor valuation report, the cash over value (COV) will be $50,000. If the HDB valuation report is only $450,000, the flat will cost $500,000, but the cash over valuation (COV) will be $50,000. As HDB will only perform the valuation after the OTP is issued, buyers and sellers faced some uncertainty.

It doesn’t matter whether you have issued the buyer an OTP or not. They can still look for other flats that are more suitable for them. The same block/level as a parent’s HBD flat may suddenly become available to an already committed buyer for a similar price. In such a situation, even if they have paid you $1,000 for the OTP, they may choose the other flat and not exercise it. Alternatively, they may find a cheaper flat, even after accounting for the option fee that they have paid.

During this period, you cannot issue an OTP to another buyer. If your buyer does not exercise his OTP within 21 working days, the option lapses, and you are allowed to grant your OTP to other buyers.

To exercise the OTP, the buyer will need to pay a deposit to you. This is an amount that should not exceed $5,000.

Step 3: Once The Buyer Exercise The OTP, You Can Start Looking For Your Private Property

Once your buyer has exercised the OTP for your HDB flat, this gives you the leeway to start looking for your private property.

At this point in time, you would already know the selling price of your HDB flat and how much cash proceed you will get from the sales. You will also have a gauge on when you are expected to hand over your keys to the new owners. This basically acts as the timeline to finding your new place.

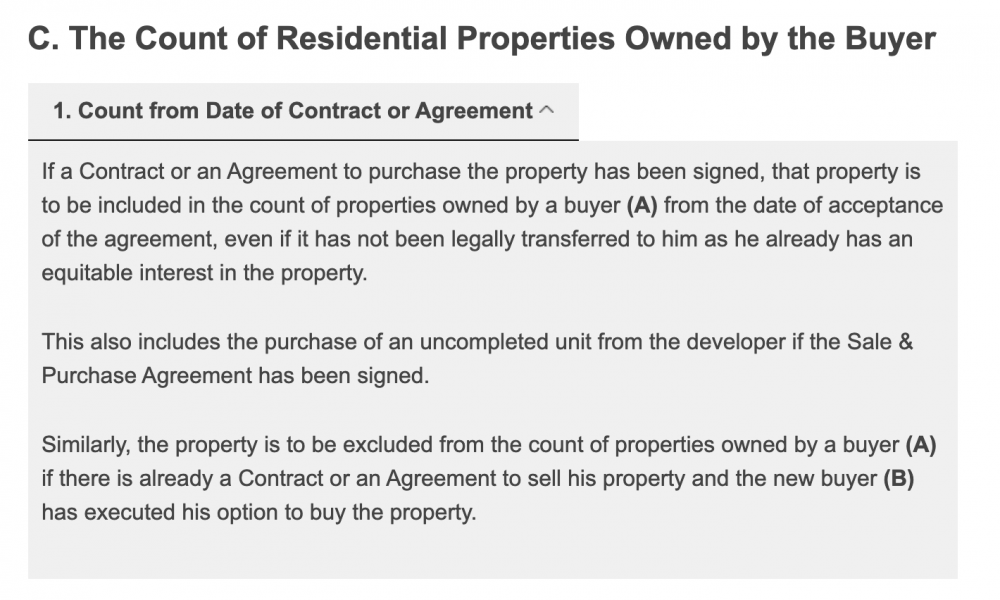

Most importantly, according to IRAS, once an agreement to sell your HDB has been issued and executed to buy the property, it’s no longer considered as a residential property that you own. Essentially, this means that if you buy a private property after the OTP for your HDB has been exercised by the buyer, you would not be liable for ABSD.

Source: IRAS

Depending on how urgent you need to move into your new home, you may need to speed up the process of purchasing your private property. A piece of advice here would be to shortlist a few potential places that you can afford in advance before you sell your HDB flat. This allows you to immediately start looking and negotiating for your private property purchase once your buyer has exercised the option to purchase your HDB flat,

Alternatively, if you have interim housing solutions for your family, you will have more time to search for your next property purchase.

Step 4: Calculate Carefully Your Cash Flow Timeline From Selling The HDB Flat

Being able to afford to upgrade from an HDB flat to a private property is one thing. Managing the cash flow situation that is required to complete the transaction smoothly is another. Here’s a scenario to explain.

Let’s assume you have sold your HDB flat for $500,000. With an existing loan of $200,000, your proceeds will be $300,000. Of this, $150,000 needs to be refunded to your CPF Ordinary Account (OA). We also assume that the private property purchase would be $1 million.

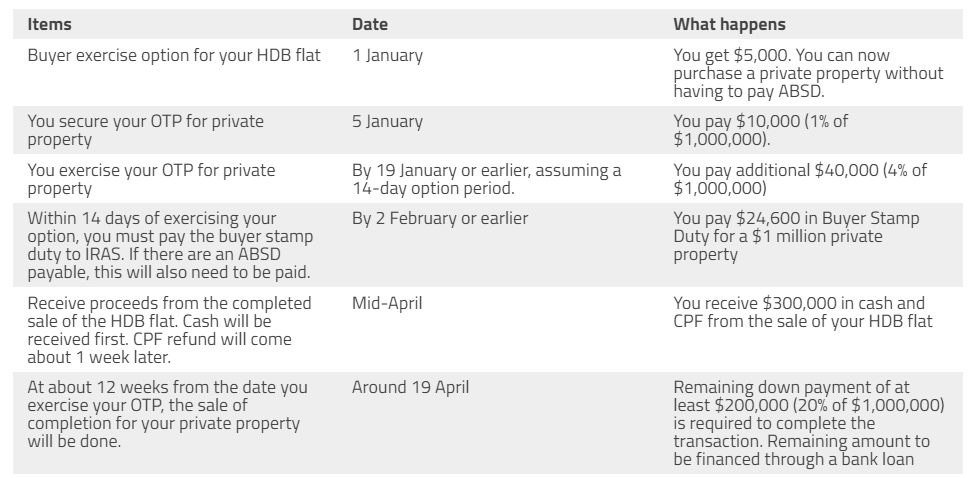

For simplicity, let’s assume that the option for your HDB flat was exercised on 1 January. After the option had been exercised, both buyers and sellers must submit a resale application for HDB to approve. We assume that this was done in 2 weeks’ time, on 15 January.

Upon receiving the resale application, HDB will post the application results – if all documents are in order – within 14 working days (about three weeks),. This will bring us to the first week of February.

Upon HDB’s acceptance, it will take about 8 weeks from the date of acceptance to process the sales application. Based on the timeline, this brings us to the first week of April. You will receive your cash proceeds during that period, but it will take about a week before the refund is made to your CPF. This means that you will only have the full disposable cash and CPF amount of $300,000 to utilise for your private property purchase sometime in mid-April.

Step 5: Cashflow Timeline For Buying A Private Property

The cash flow timeline from purchasing a private property is crucial. Since the HDB flat has been sold for $500,000 with an outstanding loan of $200,000, you will get a sales balance of $300,000. On paper, with $300,000 in cash and CPF to deploy, you would be able to meet the minimum down payment requirement of $250,000 (25% of $1 million).

However, that is not the only thing to be concerned about. Cash flow timeline management is also vital.

To make an offer for a private property, you usually have to pay an option fee of 1%. This means that you need $10,000 in cash to secure the OTP. By default, you need to pay the remaining 4% to exercise your option within two weeks though you can negotiate the option period with the seller.

Thus, to exercise the option, you need a total of $50,000 in cash. This means that you either need to have the cash on hand to secure and exercise the OTP, or wait till early April when you receive the cash proceeds from the completed sale of the HDB flat. You will also need to pay the buyer stamp duty in cash, which is about $24,600 for a $1 million property. All in all, the total cash outlay to secure the OTP, exercise the option and pay the buyer stamp duty is $74,600, for a $1 million private property.

Assuming you have enough cash, you have the means to start searching, secure the OTP and exercise the option for your private property before early April. If you do not have enough cash, you will need to wait until the full amount from the sale of your HDB flat is credited to you.

Typically, upon exercising your option for a private property purchase, it will take about 12 weeks for the date of completion for the property. Say, if your HDB option was exercised on 1 January, and you exercised the option to purchase your private property on 19 January, then the date of completion would be around 19 April. This gives you just enough time to ensure that you have received the proceeds from the sale of your HDB, to pay for the down payment required for your private property.

The table below shows the timeline beginning from the sale of your HDB flat to the purchase of your private property.

As you can see from the table above, the timeline is relatively tight when it comes to when you would receive the full amount from the sale of your HDB flat, and when you need to pay the down payment to complete the purchase of your private property. If you don’t have enough funds, you will need to delay the completion of your private property purchase.

During this period, you will need to secure the bank loan required to finance your private property purchase and engage a law firm to assist you with the paperwork required to complete your property transaction. Legal fees would typically cost you between $2,500 to $3,000. You will also need to pay the commission to your agent, which will typically be deducted from the proceeds that you get from the sale of your HDB flat.

For more property articles please contact us +6582828214.

GET IN TOUCH

We will love to answer any queries you might have. Submit this form and we will be in touch with you shortly.

For Free Consultation. Kindly Contact Our Team At +6569028874.

KUMAR PROPERTIES

Find Your Dream Home

SITELINKS

Kumar Properties

About Kumar

Services

Client Testimonials

Mortgage Calculator

Valuation

Recent Comments