Steps to Upgrade to an HDB Resale Flat?

Kumar Properties

Steps to Upgrade to an HDB Resale Flat?

When can you upgrade from your HDB flat?

Usually, those who purchased HDB, must wait 5 years to sell HDB property and buy other private property. HDB properties have Minimum Occupation Period (MOP). During MOP period, you must live in the HDB flat you bought. During MOP, few things should not be done like:

- Selling HDB flat

- Buying a second HDB flat

- Investing in other private property

- Buying property in abroad

These rules are applicable for the resale HDB flat too. For 1-bedder there is no MOP but not for above 2 bedder HDB flats. Here are the guidelines for the above 2 bedroom flats:

| Purchase Mode | MOP |

| Bought new HDB flat (including buying under SERS) | 5 years |

| Bought new DBSS flat from developer | 5 years |

| Bought resale flat with CPF housing grant | 5 years |

| Bought Resale flat without grant (after Aug 2010) | 5 years |

| Bought Resale flat without grant(Mar to Aug 2010) | 3 years |

| Bought Resale flat without grant(before 5 Mar 2010) | 2.5 years |

Which property you can upgrade after MOP?

When your MOP is up, you have many options to purchase second property. Some of the most popular are:

- Resale HDB flat: Investing resale HDB flat is the cheapest and easiest option, some of the prices of the flats are below $400,000. In HDB resale portal, you can find and purchase an HDB resale flat easily. Upgrading from HDB to a new HDB may not be much difference but upgrading to resale HDB flats in mature estates like Bishan and Queenstown are larger and more spacious. If you want to upgrade your home for good schools for your children.

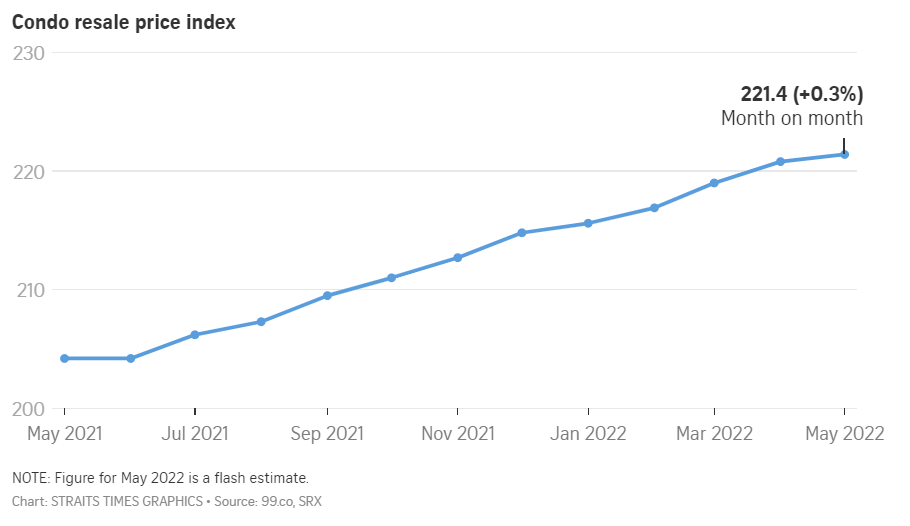

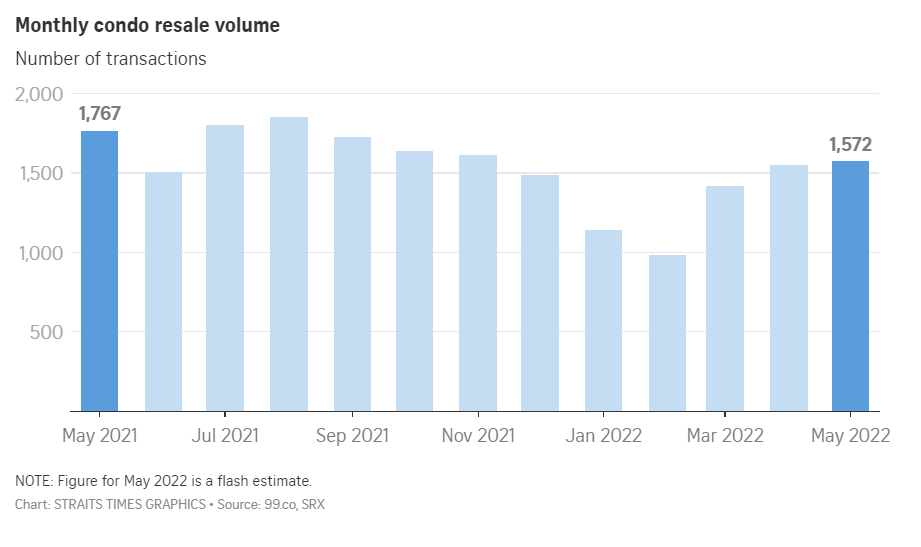

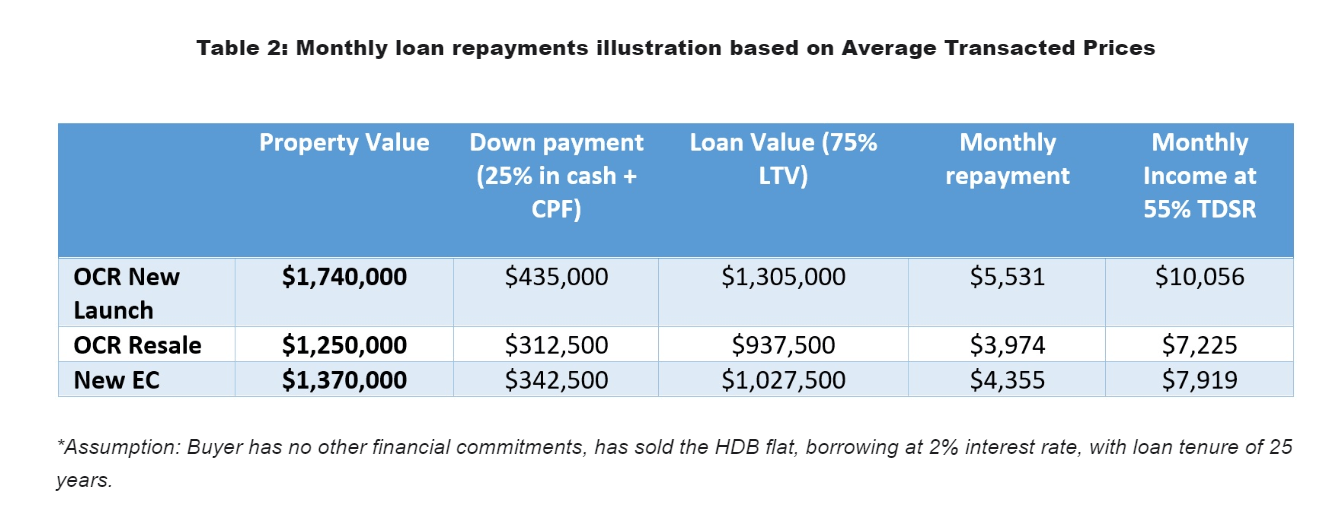

- Condominium: The most popular option for most HDB upgraders is condo properties. When a property becomes older property value also increases. According to the price, private condos are more expensive than resale HDB flats, mostly prices starting from $1.5 million.

- Landed Property: landed properties are more expensive than condo properties, prices of landed properties start from $2 million, which is considered a cheap in cost for landed properties in Singapore. For upgrading any type of property, a property agent is needed to make the process easy. Kumar is one of the property agents in Singapore, he serves all the clients and also helps you to understand the property market. We’ll guide you step-by-step procedure for upgrading any property.

Steps to Upgrade to an HDB Resale Flat?

Upgrading property is the biggest dream to many of the property owners. If you have decided to upgrade for an HDB resale flat, here is a step-by-step procedure to upgrade your property.

Step 1: Choose your resale flat

Before choosing a resale flat, first of all, decide to engage a top property agent. The real estate agent is necessary to do all those works like legal work and paperwork for your property upgrade. They not only help you in paperwork but also guide you to choose the right property and how to sell your first property above your market value.

The further step is to figure out all your requirement like location, no. of bedrooms, amenities and budget to buy a resale HDB flat. Next according to your requirements, find a resale HDB unit in different property portals else you can say to your agent for choosing the right property.

Step 2: Check the flat before you invest

Before you invest in resale HDB flat, book showflat appointment and visit the flat to check condition of the HDB resale unit. There are some other things to consider, they are

- Ethnic and PR quota – You can check the status of this in HDB quota portal because it will change from month to month.

- HDB Ownership – You should also make sure about the seller details like HDB is legally owned and met MOP or not.

- Upgrading Works – Make sure about the payment of upgrading works wh should pay you or your seller.

- HDB Resale Prices – according to your budget choose right property and quote right price by checking recent transacted HDB prices.

- Leasehold Period – For every HDB leasehold will be 99 years. Before you invest in property check how many years left on the lease. Because of the lease, it may affect your home loans and how much of your CPF you can use. For the new CPF rules lease period should be atleast 20 years left on the lease, with the youngest buyer up to the age of 95 able to pay the lease using CPF.

Next procedure is exercise your option to purchase and pay a deposit to the seller.

Step 3: Start using HDB Resale Portal

To know exact transaction details, both buyer and seller need to browse HDB resale portal. Register with the HDB resale portal then it will say you what to do.

Step 4: Check out your eligible for the proximity housing grant

The price of a 5-room HDB resale flat can be anywhere from $400,000 (Sembawang) to $850,000 (Toa Payoh). Since most people don’t have such a lot of money lying around, grants are helpful. Unfortunately, HDB schemes are primarily aimed at first-time buyers. Second-time buyers can only apply for the Proximity Housing Grant. If you buy a resale flat within 4 kilometers of your parents or in-laws, it’s $20,000 if you get them to live with you. Importantly, these living arrangements must remain the same throughout the MOP.

Step 5: Finance your resale HDB

The Enhanced Contra Facility of HDB is the most useful scheme for upgraders. This allows you to sell your current HDB flat and buy a resale at the same time. The proceeds from your sale and your refunded CPF can be used to finance your new resale flat, reducing the amount of cash you’ll need up front and the amount of loan you’ll need. When it comes to financing your HDB upgrade, there’s actually a fixed order to follow.

| Financing Method | Notes |

| Cash received by selling first HDB flat | You have to use atleast 50% for resale HDB |

| CPF (OA) | You can CPF use only when you don’t have cash and also you can withdrawal limit amount. |

| HDB loan | If you’re eligible, You can use after using cash & CPF |

| Bank loan | If you’re not eligible for HDB loan you can use but the loan limit is 75% for first mortgage) and 45% of second mortgage. |

Step 6: Handovering your first HDB flat keys in 6 months

Last but not least is you can’t buy 2 HDB flats at a time so, you need to sell your HDB flat and handover keys to your buyer. Then only you can buy other HDB.

So selling your HDB flat also need to contact property agent. Before selling you need to valuate your property. Kumar Properties is a property agency, we will you in every step of property selling and buying process. We will make hassle free process. So contact +65 82828214.

GET IN TOUCH

We will love to answer any queries you might have. Submit this form and we will be in touch with you shortly.

For Free Consultation. Kindly Contact Our Team At +6569028874.

KUMAR PROPERTIES

Find Your Dream Home

SITELINKS

Kumar Properties

About Kumar

Services

Client Testimonials

Mortgage Calculator

Valuation

Recent Comments