Things to know before upgrading to a private property?

Kumar Properties

Things to know before upgrading to Private Property

Upgrading from HDB to a private condo is followed by many people. Numerous Singaporean families turned their dream into a reality of buying and staying in condo. Several households currently wanted to live in private condos rather than in HDB for exclusive facilities and different lifestyles.

Due to the growth of the HDB resale prices in the past few years, many of the house owners have decided to upgrade their property. In the second half of the 2019 HDB resale price values started to recover after booking six consecutive years of decline. In 2021, there is a sudden increase of HDB resale prices by 12.7%, following a 5% increase in 2020. Because of this reason many owners are selling their HDB flat and investing private property.

Things to consider for upgrading property

Are you completed your 5 years minimum occupation period (MOP) for HDB?

Do You want to upgrade your HDB flat to private condo?

There are several things to consider to upgrade property in Singapore. Read this articles to know more.

1. Find objective for upgrading to private condo

First of make clear idea about why do you want to upgrade from HDB to a private condo. Private property provides you privacy in gated condo system and also use of different condo facilities like a swimming pool, yoga pavilion, herb garden, clubhouse, gym, tennis court and other facilities. These facilities are one of the reasons to upgrade property from HDB to condo property, which are highly attractive. One reason is facilities another reason will be the rise of private property prices in future. Here is the URA Private property prices index (PPI) and HDB Resale prices index (HRPI). By observing this chart, know that private property price growth rate is more than the HDB resale prices (See Chart 1).

Upgraders are mostly concentrating on mass-market private homes in the outside central region (OCR) or Executive condos (EC’s). Executive condos are a type of public and private housing hybrid. Now a day’s residential property prices have continuously increased and reached a peak point.

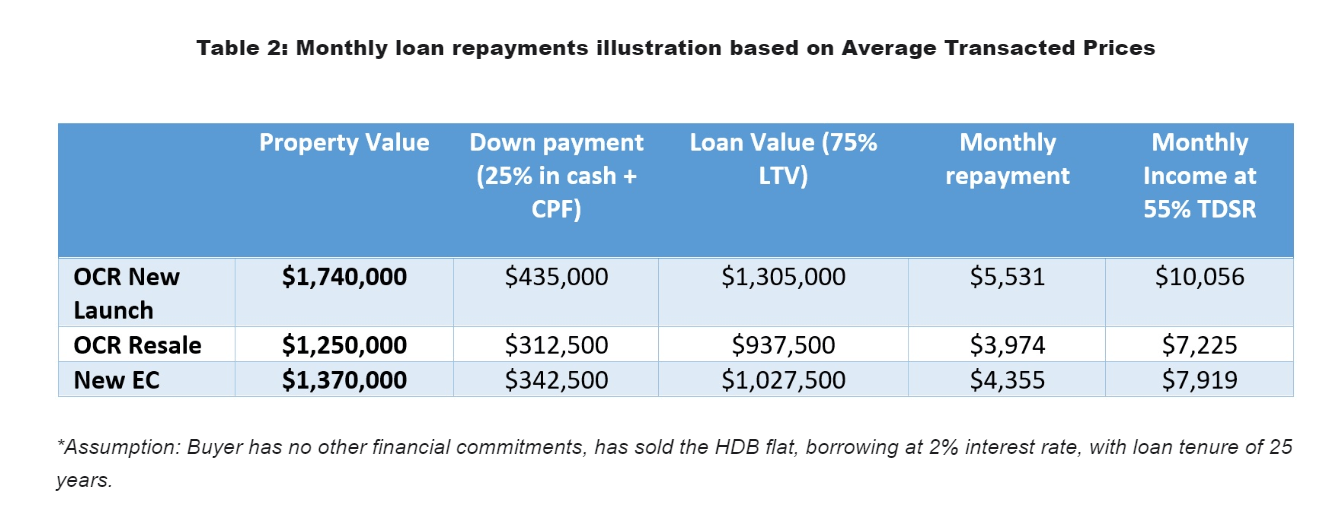

Based on URA Realis caveat data, the average price in 2021 for new launches, resales and new EC projects were $1.74M, $1.25M and $1.37M, respectively (see Table 1).

If the upgrader has sold the flat and has no other financial commitments, buyers will have to pay a monthly loan repayment between $3,900 and $5,500 at these prices. Using a 75% loan to value loan at a rate of 2% and a 25-year loan, Table 2 illustrates the buyer’s financial outlay.

Prior to making such a big purchase as a new home, prospective buyers should consult with an experienced realtor or financial advisor.

It is also important to consider how much maintenance or service and conservation charges are payable each month if you are living in a private condo rather than a HDB flat. A four-room HDB flat’s S&CC is usually about $64 and a five-room flat’s about $80. A condo maintenance fee, on the other hand, can easily go over a hundred dollars, and it depends on the size and value of the unit. In addition, private condo owners may not enjoy certain incentives offered by the government, such as S&CC rebates for example.

When the couple sells their apartment (which was joint bought) and buys a new house, they will be able to “decouple” – they will purchase the new house under one name. As this would be the individual’s first home purchase, he will be able to purchase a residential property in the future without paying additional buyer’s stamp duty.

There is no way to perfectly time the market, but would-be buyers could take some advice from price movements in private and HDB resale properties. If private home prices are likely to plateau or grow much more slowly, owners would be interested in taking advantage of a stronger HDB resale price growth.

In 2022, PropNex estimates HDB resale prices will increase by 6% to 8% at a faster rate than private residential properties. In contrast to the 10.6% increase in private home prices in 2021, prices are expected to rise at a slower pace this year thanks to new cooling measures implemented in December 2021.

It is likely that inflationary pressures will drive prices up this year as construction costs and manpower costs rise, but strong demand in 2021 drove prices up. Additionally, with interest rates expected to rise through 2022, some buyers may want to secure a better mortgage rate now rather than later.

GET IN TOUCH

We will love to answer any queries you might have. Submit this form and we will be in touch with you shortly.

For Free Consultation. Kindly Contact Our Team At +6569028874.

KUMAR PROPERTIES

Find Your Dream Home

SITELINKS

Kumar Properties

About Kumar

Services

Client Testimonials

Mortgage Calculator

Valuation

Recent Comments