Condo resale prices rise for 22nd straight month in May, more units sold

Kumar Properties

Condo resale prices rise for 22nd straight month in May, more units sold

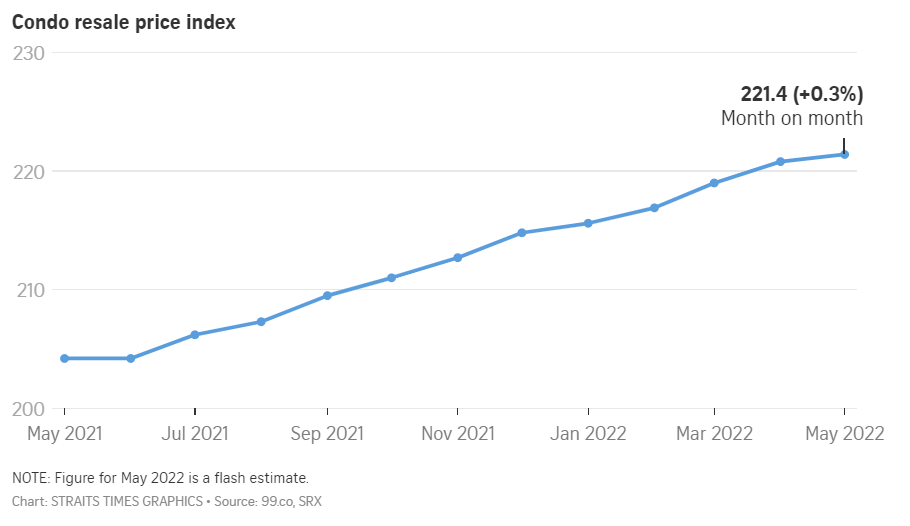

Prices of resale condominium units edged up for the 22nd straight month in May, with transactions rising as buying sentiment improved despite property cooling measures. In May, condominium resale prices rose 0.3 per cent, lower compared with April’s 0.7 per cent, according to flash figures from real estate portals 99.co and SRX released on Tuesday (June 14).

Compared with May last year, prices were up by 8.4 per cent, data showed. In May, prices of condominiums in the city fringes went up by 0.7 per cent and those in the suburbs rose by 0.5 per cent, while those in the core central region fell by 1.2 per cent.

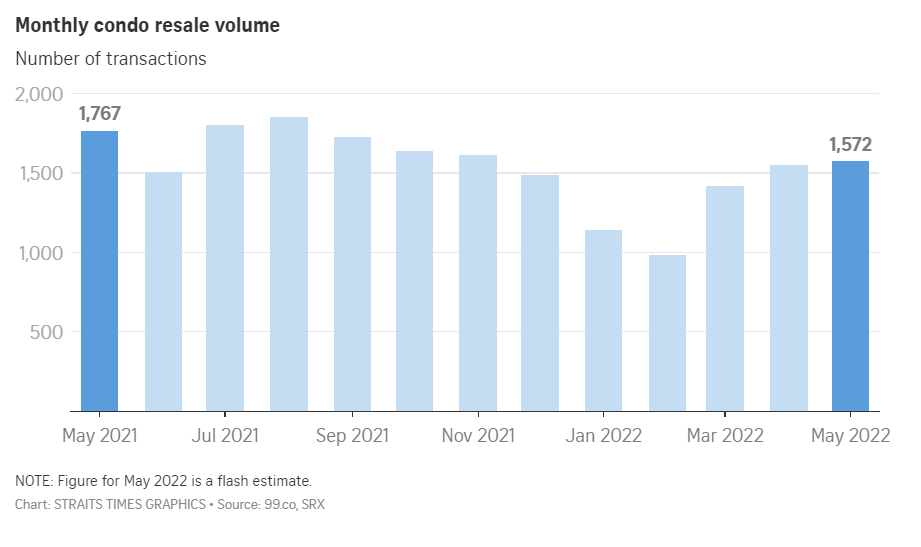

Huttons Asia chief executive Mark Yip said the successful launches of two projects in the city fringes – Piccadilly Grand in Farrer Park and LIV@MB in East Coast – resulted in demand spilling over to the resale market last month, which supported the rise in prices. Meanwhile, resale volume climbed by 1.6 per cent, with an estimated 1,572 units changing hands in May, up from 1,547 units in April.

Resale transactions declined by 11 per cent compared with May last year, but were still 40.2 per cent higher than the five-year average for the month of May. This could indicate the resale market is on its road to recovery, five months after property cooling measures were introduced last December, analysts said.

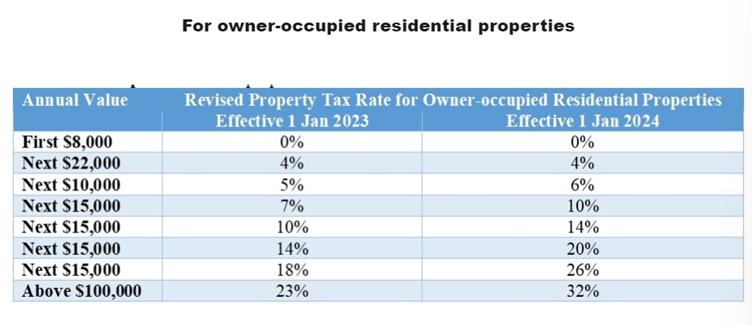

In December, the additional buyer’s stamp duty (ABSD) rates were raised from 12 per cent to 17 per cent for citizens buying their second residential property, and from 15 per cent to 25 per cent for those buying their third and subsequent ones.

For foreigners buying any residential property, the ABSD is 30 per cent, up from 20 per cent. Resale volume has been rising since March with the easing of Covid-19 restrictions, rebounding from the six-month decline starting last September.

The strong buying sentiment in the condominium resale market was reflected in the new sale market last month, noted OrangeTee & Tie senior vice-president of research and analytics Christine Sun.

“This indicates that buying sentiment has generally improved across the different housing segments and may pick up further in the coming months,” she said.

“Growing macroeconomic uncertainty may also spur more investors to park their money in safe-haven assets like properties,” she added.

PropNex Realty head of research and content Wong Siew Ying said some of the firm’s real estate agents noted that the supply of resale condominium stock has been tight as some owners choose to hold on to their properties.

“With the hefty additional buyer’s stamp duty, some owners who have purchased multiple residential properties prior to the cooling measures may be unwilling to sell now,” she said, adding that the strong home rental market could also be a reason.

Given the tight supply and demand from Housing Board upgraders, property analysts expect condominium resale prices to remain firm this year. Mr Yip said the resale market in June may be quiet as it coincides with the school holidays and there are no planned new project launches.

“Nevertheless, the return of foreigners to the property market will support further growth in prices for the rest of 2022,” he added. In May, condominiums in the suburbs accounted for 60.2 per cent of the total sales volume. Homes in the city fringes accounted for 24.7 per cent, while the remaining 15.1 per cent were in core central Singapore.

The highest transacted price for a resale condo in May was $20 million for a unit at The Nassim, a freehold development in the Tanglin area. In the city fringes, the highest transacted price was $4.85 million for a 99-year leasehold unit at Silversea in Marine Parade. In the suburban areas, a freehold unit at Clementi Park in the Sunset Way area sold for $6.5 million.

GET IN TOUCH

We will love to answer any queries you might have. Submit this form and we will be in touch with you shortly.

For Free Consultation. Kindly Contact Our Team At +6569028874.

KUMAR PROPERTIES

Find Your Dream Home

SITELINKS

Kumar Properties

About Kumar

Services

Client Testimonials

Mortgage Calculator

Valuation

Recent Comments