Looking to Buy a House in Singapore : Here is our guidance:

Kumar Properties

Looking to Buy a House in Singapore : Here is our guidance:

The Properties available for a Singaporean to buy:

Types of Properties:

- HDB flats

- Private properties

- Executive Condonium(ECs)

In Singapore the type of property you buy mainly depends on your residential status. To buy a HDB flat, one must be a permanent resident(PR) or a Singapore citizen. Singapore Citizens and PRs are allowed to purchase any type of private properties (including apartments and landed bungalows) and ECs, but do take note of certain restrictions regarding ownership of HDB flats.

The types of properties a foreigner can buy in Singapore:

Foreigners can purchase private properties like private apartments and condominiums whish is condos in short, but they need government approval to buy landed properties like bungalows. Foreigners can only buy Executive Condominiums (ECs) which complete a period of at least 10 years old. Foreigners cannot own a HDB flat in Singapore.

In order to buy a property in Singapore you need to be atleast 21 years old consists of a family nucleus. Which includes:

- Spouse and Children

- Parent and siblings

- Children under your legal custody (if widowed or divorced)

Parents can buy a condo, house or apartment for their children in the form of trust – the child will become the legal owner once, when he or she turns 21.

If a single (unmarried or divorced), want to buy a resale HDB flat the minimum legal age is 35 years old. If a person widowed or orphaned, minimum legal age is 21 years old.

Can a singaporean own more than one property in Singapore:

A Singapore citizen or PR has no limit to own number of private properties. HDB owners require to complete minimum occupation period of five years to purchase a private property. Which means if you want to own both HDB and private property, buy HDB flat complete MOP period before investing in a private property.

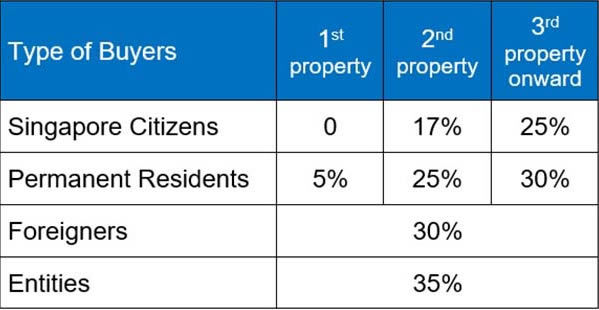

Additional Buyer’s Stamp Duty charges:

Additional Buyer’s Stamp Duty is ABSD in short. The applicable charges of ABSD for residential property is as follows.

If you want to buy a house in singapore, you should be familiarize yourself with all the different rules which governs buying a house in Singapore. You should be always:

- Use loan comparison tools to find loans and properties that matches to your unique needs.

- Think carefully before selecting the type of mortgage loan which might be a good to fit for you

- Determine what kind of LTV, monthly mortgage payments and debt obligations which are most suitable

- Calculate the loan tenure, maintenance fees and legal fees which you can afford

GET IN TOUCH

We will love to answer any queries you might have. Submit this form and we will be in touch with you shortly.

For Free Consultation. Kindly Contact Our Team At +6569028874.

KUMAR PROPERTIES

Find Your Dream Home

SITELINKS

Kumar Properties

About Kumar

Services

Client Testimonials

Mortgage Calculator

Valuation

/Blog%2028%20JAN%202021_2%20lr.jpeg)

Recent Comments