by newadmin | Nov 28, 2025 | FinTech

With extra conventional monetary establishments embracing cryptocurrencies, we will expect elevated liquidity, improved market infrastructure, and a broader range of by-product merchandise. From traditional monetary establishments to specialized crypto exchanges, there are numerous gamers shaping the future of this market. Crypto derivatives are tradable contracts that derive worth in relation to digital assets’ market prices. Traders who buy derivatives do not personal cryptocurrencies in a digital wallet; instead, they hold paper financial merchandise that give them a approach to speculate on the prices of coins like Bitcoin (BTC) or Ethereum (ETH). Revolutionary merchandise are constantly evolving in the crypto derivatives market, providing unique hedging and investment options.

- Reference to any specific strategy, technique, product, service, or entity doesn’t constitute an endorsement or recommendation by dYdX Trading Inc., or any affiliate, agent, or consultant thereof (“dYdX”).

- Also referred to as perpetuals swaps or perps, crypto perpetuals are a new breed of futures contracts, popularized by dYdX, that do not have expiry dates.

- Offering excessive leverage is not inherently predatory; it offers sophisticated traders with capital effectivity.

Perpetual Swaps

It is a risk administration technique the place a dealer takes an reverse place to an present one to offset potential losses. For instance, a Bitcoin spot holder buys an asset and then holds it until the worth (hopefully) increases. However, if they suppose the asset may lower in worth, they can take a short position on a Bitcoin futures contract, effectively hedging their position.

DYOR, or “do your own analysis,” is crucial to successful trading in any market, together with the crypto derivatives market. By conducting your individual research and evaluation, you’ll be able to better understand the market, the property you’re buying and selling, and the potential dangers and rewards concerned. The hypothesis entails taking a place on the long run worth actions of crypto to make a revenue. This permits traders to reap the advantages of the excessive volatility of the crypto market, as it may possibly assist them earn vital profits in the event that they accurately predict the lengthy run value actions of the underlying asset. In addition to miners, derivatives are additionally useful for investors and merchants in crypto asset markets.

Trade Every Market In One Place

In the crypto area, they’re usually used for rate of interest swaps or to realize exposure to specific property with out direct possession. If you’re absolutely knowledgeable and ready to go, interacting with the DeFi scene is straightforward with the Ledger ecosystem. Ledger Live provides a number of crypto trading apps which let you buy, sell, lend and borrow in one single place.

Then, this highly effective app works collectively together with your trusty Ledger device, permitting you to work together with the DeFi ecosystem, while staying protected against online threats. Trading derivatives include its personal professionals and cons that merchants must concentrate on to successfully manage their trades. For instance, if a dealer thinks that the Bitcoin worth will rise in the future, they buy a call option with a strike price of $100,000 that expires in three months. And if BTC exceeds $100,000 before expiry, the dealer may use the choice to buy at a lower cost and probably book a profit. In this text, Ledger takes a deep dive into the world of crypto derivatives, exploring what they’re https://phochominhkhai.vn/how-to-revolutionize-your-affiliate-administration/, how they work, and what you want to know earlier than getting involved. So buckle up and get ready to study all about this rapidly evolving nook of the crypto world.

The importance of crypto derivatives in the modern financial landscape extends past mere trading devices. These derivatives function vital instruments for market stabilization, threat management, and enhancing general market effectivity. Technology will play a pivotal position in shaping the future of digital asset buying and selling.

Accounting For Crypto Derivatives

Prices reacted sharply, with Bitcoin dropping from $124,000 to beneath $111,000 and Ethereum falling beneath $4,000. Despite this, historical patterns present that such stress occasions create conditions for restoration. Between 2022 and 2025, oversold RSI signals Cryptocurrency beneath 30 produced 30-day returns averaging 12.4%, and by late September indicators of accumulation confirmed the market’s resilience.

These tools allow traders to speculate on value actions with out proudly owning the precise asset, offering opportunities for hedging, portfolio optimization, and superior trading methods. As the cryptocurrency market matures, derivatives have turn out to be a cornerstone of its evolution, reshaping market dynamics and buying and selling behaviors. As we embrace the potential of crypto derivatives and the transformative function of expertise in digital asset buying and selling, it’s time to experience the future with Morpher. Morpher.com is not just a platform; it is a revolution within the buying and selling world, providing zero charges, infinite liquidity, fractional investing, and up to 10x leverage on a blockchain-powered, user-centric platform. Whether Or Not you’re interested in shares, cryptocurrencies, forex, or even area of interest markets like NFTs and sneakers, Morpher offers a unique trading experience tailored to your wants. Take control of your investments with the protection of the Morpher Wallet, and begin buying and selling with the flexibility you deserve.

That’s now starting to change, with monetary establishments exhibiting more curiosity in crypto and derivatives linked to those property. Further progress is all however sure, however the problem shall be to guarantee the nascent marketplace for digital asset derivatives is built on firm foundations. This must be primarily based on requirements that respect the distinctive aspects https://www.xcritical.com/ of this asset class and may be applied in a fully digital format – an issue that ISDA is uniquely placed to tackle. During Q3, 81% of derivatives positions had been closed within 24 hours, highlighting the speculative churn out there. Funding rates additionally reached excessive levels, with the CF Bitcoin Kraken Perpetual Index at eight.37% annualised in September. In response to the stress occasion, exchanges started introducing more dynamic funding mechanisms and stricter liquidation thresholds, which can result in extra disciplined danger administration going forward.

To get began with crypto derivatives buying and selling, it is essential to educate your self concerning the market, perceive the dangers involved, and develop a threat management strategy. Additionally, you’ll have the ability to open an account with a reputable crypto derivatives change and familiarize your self with their buying and selling platform and tools. Swapping digital property isn’t the one method to commerce cryptocurrencies, neither is it the most well-liked method to speculate on virtual spot market vs derivative market coins. Current buying and selling activity suggests monetary instruments known as derivatives are more commonly utilized by crypto merchants than the cryptocurrencies they represent.

by newadmin | Nov 19, 2025 | FinTech

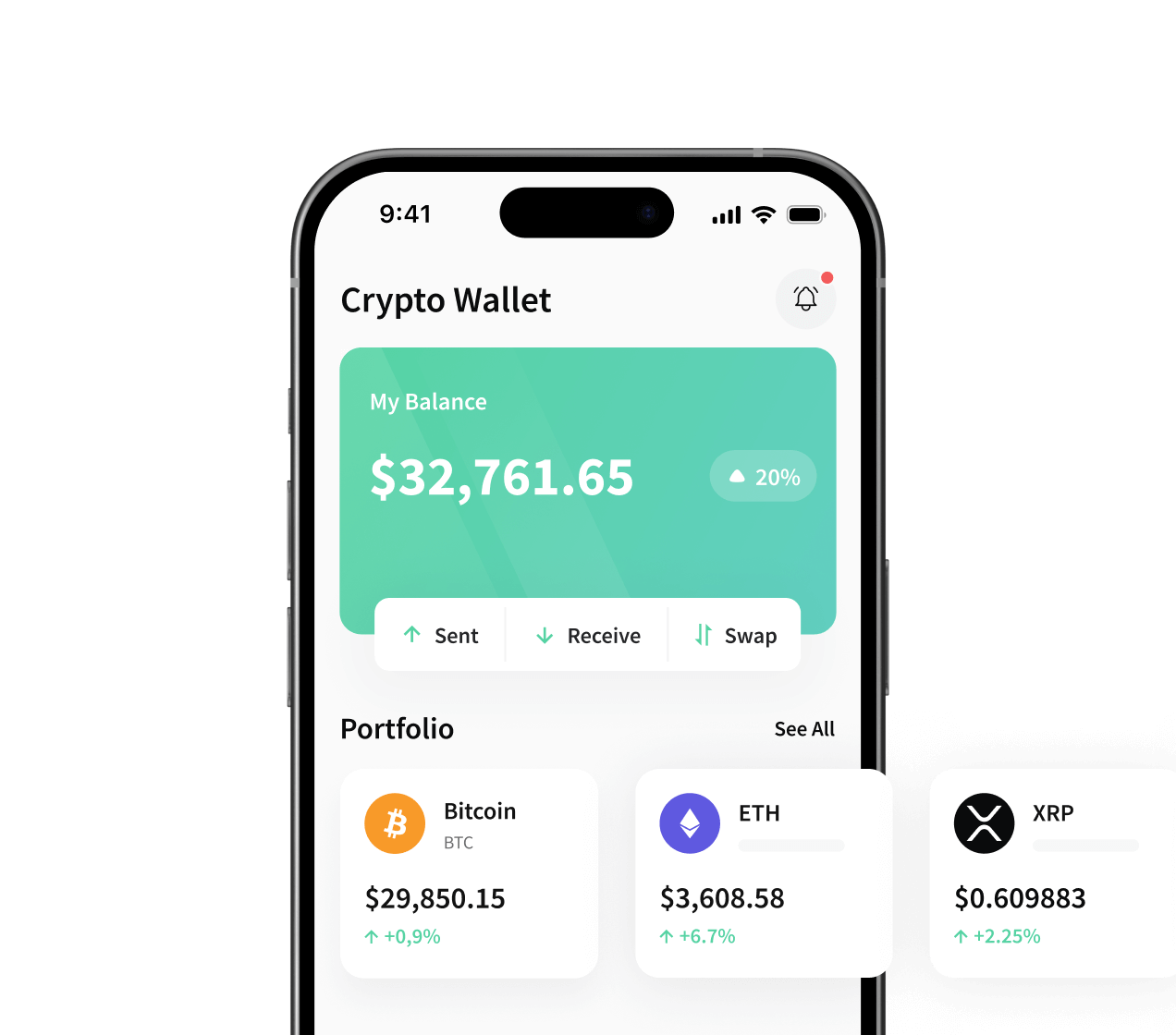

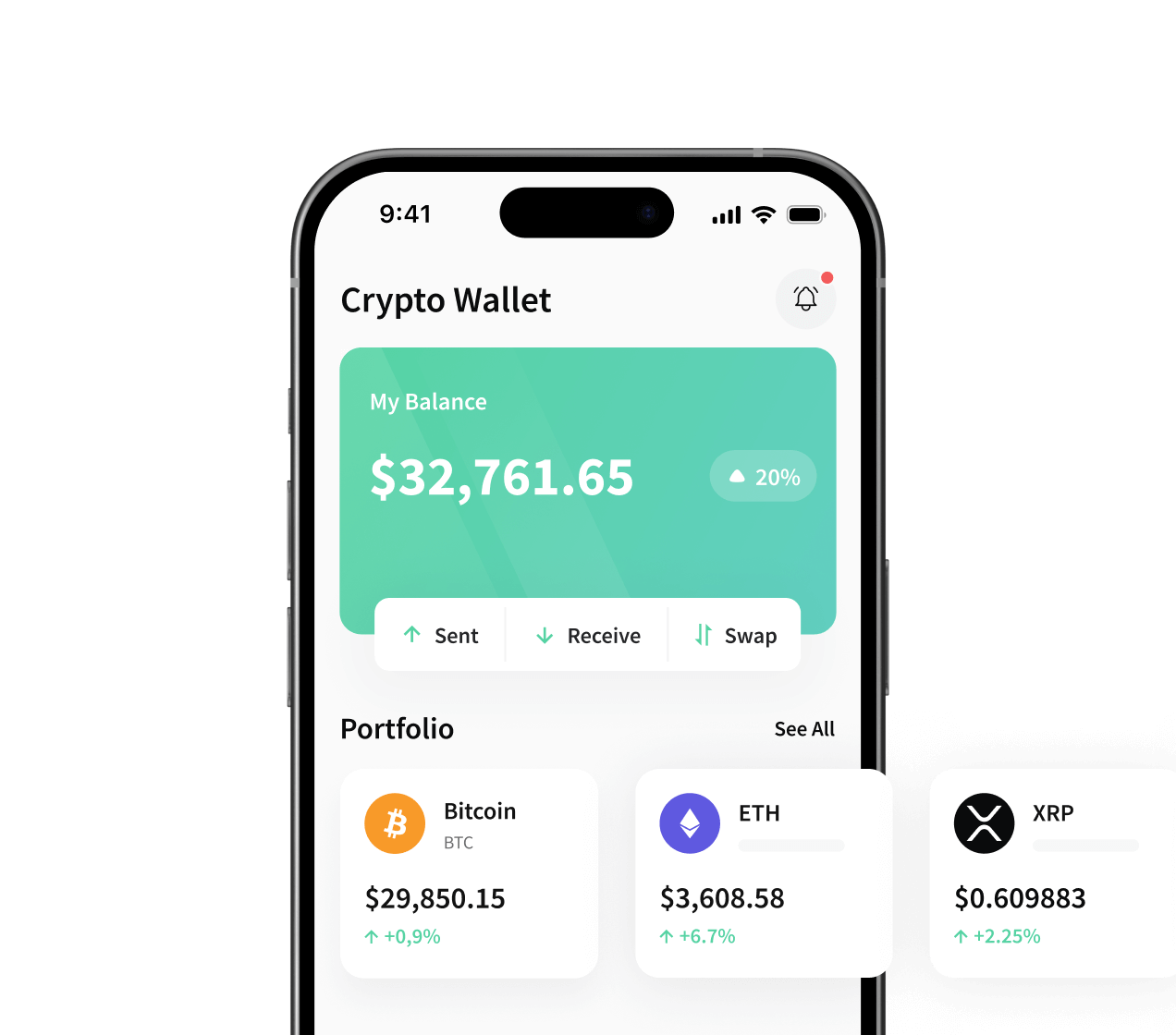

Growing a safe and feature-rich crypto pockets is essential for companies trying to enter the digital asset area. SDK.finance offers a robust crypto wallet development platform that allows businesses to construct, customise, and scale digital wallets with seamless integration of cryptocurrencies and fiat transactions. Exodus Wallet is a non-custodial software wallet renowned for its intuitive design and in depth crypto wallet support for numerous cryptocurrencies.

Staking typically requires you to make use of a coin-specific pockets to enter the stake pool after which get rewarded with the same coins. A paper “wallet” is simply a chunk of paper together with your non-public keys written on it. This is technically a type of cold wallet as it’s disconnected from the internet. So while paper is safe from cyber attacks, your data can easily be utilized by anyone who features access to it.

With this info, you’ll be even more empowered to make the proper name when it comes to which cash — and other belongings — to hold and which to promote to succeed in your funding goals. According to Benzinga, you only need to commerce three different cryptocurrencies before you become a great candidate for a crypto tracker portfolio. Run on programmable logic that enables automation, restoration features, and spending controls. Our staff of creative thinkers and tech wizards collaborates to craft apps that function flawlessly.

All Types Of Crypto Wallets Defined ( : Hot, Cold, Custodial, Non-custodial & More

CoinsPaid is an Estonia-based crypto cost processor founded in 2014, serving over 800 merchants with a powerful concentrate on the gaming vertical. The platform processes approximately €1 billion in month-to-month quantity and handles 0.8% of world Bitcoin exercise, with explicit power in gaming partnerships together with SoftSwiss integration. Getting all your crypto cash, wallets, and other belongings beneath one roof may sound like the opposite of diversification, but it’s actually an effective way to make your diversification efforts simpler. We’re not speaking about storing them all in one platform, we’re just talking about taking benefit of a singular platform from which they’ll all be seen simply. As you might have found during your journey through investing in cryptocurrency, many or even most crypto-specific wallets don’t work with a quantity of completely different cryptocurrencies.

Key Features Of Our Crypto Pockets Software

- They enable cross-chain swaps immediately within the pockets, permitting users to maneuver tokens between networks seamlessly with out relying on third-party bridges.

- We weren’t surprised to be taught that 60% of people report high quality of life improvements simply from using wealth management instruments.

- Completely, SDK.finance provides a supply code license, allowing monetary institutions full control and customisation of their crypto banking platform.

- On-ramp allows clients to buy crypto using fiat funds, while off-ramp permits the sale of crypto with instant settlement to fiat wallets.

This is what makes chilly hardware wallets a perfect device for holding giant quantities of crypto. So when you use Exodus to retailer your private Bitcoin keys, you’d be capable of pop open their desktop or cellular app to entry this info or take part in peer-to-peer trading of over one hundred totally different cash. Whether you’re a whale or a complete crypto beginner, the BitPay Wallet provides a buttery clean person expertise that’ll have you ever spending, swapping and sending very quickly flat. Multi-chain wallets speak the “language” of varied blockchains, pre-programmed with the foundations and technological specs for each. From a multi-chain wallet interface, customers can simply faucet the blockchain network they want to hook up with, switching backwards and forwards as wanted.

Unlike suppliers built for retail adoption or particular regional markets, we combine world licensing, multi-token and chain help, best-in-class consumer experience, and fast, compliant settlement. Today’s crypto ecosystem consists of tens of hundreds of cryptocurrencies and over 1,000 blockchains. Most blockchain networks use specific technology and function beneath their very own units of rules, which suggests they’re not often cross-compatible. For users with a diverse portfolio of assets, multi-chain wallets make it straightforward to manage cryptocurrencies across multiple blockchains from one place, permitting users to save lots of money and time. If you’re looking to simplify your crypto life, learn on to discover methods to create a multi-chain pockets with BitPay.

Spend

This listing covers software program wallets, hardware wallets, multi-currency wallets, and privacy-focused choices. Triple A is a Singapore-based payment gateway focused primarily on the Asia-Pacific and MENA regions. The firm supports key cryptocurrencies (Bitcoin, Ethereum, USDT, USDC, and Binance Pay) and provides crypto-to-fiat conversion with payouts to a number of fiat currencies.

No Good Absolutely Open Supply Multi Crypto Wallets

These wallets are finest for individuals who favor to carry crypto long run without frequent transactions. This makes them best for frequent transactions but also more uncovered to hacking makes an attempt. Please note that the provision of the services and products on the Wirex app is subject to jurisdictional limitations. Wirex could not provide certain merchandise, options and/or companies on the Wirex app in sure jurisdictions as a end result of potential or precise regulatory restrictions.

Create API keys, handle subscription plans, monitor utilization, and configure settings – multi functional place. Get API keys, generate addresses, setup webhooks, monitor failed requests, callbacks and extra. Integrates with Ethereum dApps and DeFi; supports ERC-20 tokens and NFTs. Over $25 billion in annual volumes with half in stablecoin pay-ins demonstrates each scale and stablecoin-native focus. In addition, we even offer an affordable white-label option for modern financial advisors.

It’s not nearly storage anymore, it’s about interoperability, seamless user expertise, and enterprise readiness. Wallets that combine cell comfort with hardware-grade protection will outline the winners on this house. These wallets showcase what one of the best multi currency wallet for Android can obtain when safety meets mobility. Ought To you depend on a multi forex hardware pockets or a cell solution?

by newadmin | Sep 12, 2025 | FinTech

For instance, a BitVol worth of eighty signifies 80% annualized implied volatility. The sponsor of the belief is iShares Delaware Trust Sponsor LLC (the “Sponsor”). BlackRock Investments, LLC (“BRIL”), assists in the promotion of the Trust. This is higher than the everyday ranges of volatility seen in different asset classes. Fidelity Digital Belongings and the Constancy Digital Property brand are registered service marks of FMR LLC. In its mere 15 years of existence, bitcoin has shown indicators of maturation.

In this article, we will delve into the idea of volatility in crypto, exploring its causes and results on the market, as well as strategies to mitigate the dangers. Bitcoin has traditionally exhibited high volatility or high measures of standard deviation, but when examining its returns, many are disproportionately skewed to the positive aspect. All in all, since leverage will increase the volatility of crypto belongings, merchants ought to rigorously think about the risks of this technique and use strategies like stop-loss orders to keep away from liquidation. Whereas these dramatic actions give traders ample opportunities, in addition they ramp up the risk profile for crypto assets. For most profitability (not to say peace of mind), crypto traders are often on the hunt for strategies to handle the spikes and dips of their portfolios.

Crypto Value Modifications Explained

Funds in your HYCA are automatically deposited into companion banks (“Partner Banks”), the place that cash earns interest and is eligible for FDIC insurance coverage. Your Annual Percentage Yield is variable and may change at the discretion of the Partner Banks or Public Investing. Apex Clearing and Public Investing receive administrative charges for working this program, which reduce the quantity of interest paid on swept cash. Neither Public Investing nor any of its associates is a bank. The Commodity Channel Index identifies cyclical turns or trend reversals, measuring the distinction between the present worth and the historical average worth of a safety or commodity. Bollinger Bands are a volatility indicator that present potential price breakouts and reversals.

Digital assets characterize a new and quickly evolving business, and the value of the Shares is dependent upon their acceptance. A disruption of the web or a digital asset community would have an effect on the flexibility to switch digital assets and, consequently, would impact their worth. Engaging in any activity involving crypto-assets (including staking, buying and selling crypto assets and depositing into the MegaVault) is risky as a result of high volatility. Returns are not guaranteed and will fluctuate over time relying on multiple factors, and you might lose your entire funding, notably when utilizing leverage. The inclusion of any launchable market on dYdX does not symbolize endorsement of the initiatives and all listings are community-driven.

How Does Leverage In Crypto Impact Volatility?

You should not construe any such info or other materials as authorized, tax, funding, monetary, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, suggestion, endorsement, or supply by Crypto.com to speculate, purchase, or promote any coins, tokens, or different crypto belongings. Returns on the buying and selling of crypto belongings may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com merchandise or options are merely for illustrative functions and don’t constitute an endorsement, invitation, or solicitation.

These are measures of historic volatility based on previous Bitcoin prices. When the Bitcoin options market matures, it will be possible to calculate Bitcoin’s implied volatility, which is in some ways a better measure. Before investing in an ETF, learn the prospectus for particulars on its goals, dangers, expenses, expenses, and distinctive danger profile. Past efficiency does not guarantee future results, and investment values could rise or fall. A spot bitcoin ETP is not registered underneath the Funding Company Act of 1940 or regulated underneath the Commodity Exchange Act.

Be Part Of Our Free Publication For Every Day Crypto Updates!

Previous efficiency just isn’t a guarantee or predictor of future efficiency. The value of crypto belongings can enhance or decrease, and you can lose all or a substantial quantity of your buy price. When assessing a crypto asset, it’s essential so that you simply can do your analysis and due diligence to make the very best judgement, as any purchases shall be your sole duty. Bitcoin’s volatility implies that buying and selling it could be both extremely profitable and extremely risky. As such, it’s important to be mentally and financially prepared for the potential for important losses — as nicely as positive aspects.

- Although the common volatility for Bitcoin has decreased lately, one of the defining characteristics of all cryptocurrencies is their sharp and sudden worth modifications.

- By persevering with to entry this content, you agree to the above and accept the potential for modifications within the information offered.

- One issue that’s common among nearly all cryptocurrencies is that it is onerous to identify their truthful value.

- You should consult your personal tax, legal, and accounting advisors before engaging in any transaction.

- Retail buyers who enter the crypto buying and selling world may not always be so lucky thanks to high volatility.

- When crypto prices swing hard, so do your investment results.

Why Is Bitcoin So Volatile?

On the other hand, day traders and options merchants are inclined to focus intently on volatility that happens over a lot shorter periods of time, a couple of days or even mere seconds. Their objective is to revenue from volatility utilizing quite so much of methods. This data should not be relied upon as research, investment recommendation, or a advice regarding any merchandise, strategies, or any safety in particular. This materials is strictly for illustrative, academic, or informational purposes and is topic to vary. Cryptocurrency volumes can also be http://neutrino.net.ru/pochva/page,1,8555,153-zagotavlivaem-kompost.html delicate to geopolitical information. Bitcoin buying and selling, and its worth, surged in 2020 — and this was extensively linked to COVID-19.

When bitcoin has gone a long stretch without an all-time high, we see seller energy entering above the ninety fifth percentile. As to be expected, a younger and nascent commodity or asset class with a small market cap is more more doubtless to experience higher volatility as new capital flows into the asset. Bitcoin has been no exception with common volatility within the triple digits, even breaching 200% on an annualized foundation in its early years. The data supplied herein is for common informational functions only, and DI reserves the best to replace, modify, or amend any contents herein, at its sole discretion and without prior discover. Nothing herein should be used or considered as legal, monetary, tax, or some other recommendation, nor as an instruction or invitation to act in any means by anyone. The info supplied herein is for basic informational functions solely, and DI reserves the right to update, modify, or amend any contents herein, at its sole discretion and without prior discover.

The function of this web site is solely to show information regarding the services and products out there on the Crypto.com App. It just isn’t intended to offer entry to any of such services. You may obtain access to such products and services on the Crypto.com App. This web site tracks the volatility of the Bitcoin value in US dollars. Bollinger Bands are represented by a center band (Simple Shifting Common or SMA) and two outer bands that are commonplace deviations away from the center band.

by newadmin | Jun 20, 2024 | FinTech

Nevertheless, neither IBKR nor its associates warrant its completeness, accuracy or adequacy. IBKR does not make any representations or warranties regarding the past or future efficiency of any financial instrument. By posting materials on IBKR Campus, IBKR isn’t representing that any explicit monetary instrument or buying and selling technique is suitable for you. When an arbitrage opportunity arises because of misquoting in costs, it may be very advantageous to the algorithmic trading technique. Although, such opportunities exist for a very brief period as the prices out there get adjusted rapidly. And that’s why this is the best use of algorithmic trading methods, as an automated machine can monitor such changes instantly.

The 1% surcharge would apply to all balances within the highest tier. $25,000 remains to be requirement to day trade actively in the USA. You might need to have no much less than barely extra in case there are any interim losses. This site is protected by reCAPTCHA and the Google Privateness Coverage and Terms of Service apply. If you could have Blockchain any questions or comments, or are interested in changing into a contributor to the IBKR Campus, please contact us right here.

Paper Trading With Interactive Brokers¶

- Let’s dive into what it take to algo-trade with Interactive Brokers.

- This methodology of following trends is identified as momentum trading strategies.

- Strategies based mostly on either past returns (price momentum strategies) or earnings shock (known as earnings momentum strategies) exploit market under-reaction to different items of data.

- Users can set predefined danger parameters, corresponding to stop-loss ranges and position sizing, to guard their capital and reduce potential losses.

Nothing contained on our website constitutes a solicitation, recommendation, endorsement, or offer by Breaking Equity or any third get together service provider. None of the brokers listed are affiliated with Breaking Equity and don’t endorse or advocate any information supplied by Breaking Fairness. There is no guarantee that customers could have related experiences or success. Once your regular buying and selling account has been accredited and funded, you’re eligible to open a Paper Trading Account. The Accumulate/Distribute algorithm helps buyers discreetly enter large volume orders and execute trades over time with minimal market impact and lesser threat of detection by market individuals. Stay tuned for Part II to find out about other algorithmic trading methods.

Financedatabase Information – A Comprehensive Database Of Economic Symbols (python Package)

IBridgePy additionally offers in depth documentation and community assist, additional simplifying the training curve for new customers. This mixture of ease-of-use, flexibility, and broad market access makes IBridgePy a well-liked selection for anybody seeking to automate their buying and selling methods with minimal complexity. IBridgePy is a Python-based algorithmic buying and selling platform recognized for its simplicity and user-friendly design, making it one of the best platforms to make use of for algorithmic traders.

Breaking Information

Whether you’re a seasoned dealer or a novice, IBKR’s automation capabilities can streamline your buying and selling routine and improve general performance. Pairs trading is one of the several strategies collectively known as Statistical Arbitrage Strategies. In a pairs trade technique, stocks that exhibit historical co-movement in prices are paired utilizing basic or market-based similarities. Before shifting forward, take a fast have a look at the 15 hottest algo buying and selling strategies, used by merchants and traders to automate their buying and selling choices. IB is a US-based dealer that has an API that lets traders send trade orders by way of algorithms.

Algorithmic trading methods are merely methods that are coded in a pc language such as Python for executing commerce orders. The trader codes these strategies to use the processing capabilities of a computer for taking trades in a extra efficient manner with no to minimal intervention. All Through api trading the lesson, please keep in mind that the examples mentioned are purely for technical demonstration functions, and don’t constitute buying and selling advice. Also, you will want to keep in mind that inserting trades in a paper account is recommended earlier than any stay buying and selling. Automated techniques function primarily based on predefined guidelines, eliminating emotional decision-making. This helps traders stick with their methods and avoid impulsive actions driven by concern or greed.

The IBKR Adaptive Cease Limit Algorithm Order type is on the market for US Shares in addition to some international equities. We also can have a glance at earnings to understand the movements in stock prices. Methods primarily based on both past returns (price momentum strategies) or earnings surprise (known as earnings momentum strategies) exploit market under-reaction to totally different pieces of knowledge.

In this case, I maintain it easy and just purchase 10 shares of AAPL. IB expects the order to be a Python object with purchase or promote, amount, and order type. Finally, I ship the order, wait three seconds, cancel it for the sake of this demo, wait three extra https://www.xcritical.com/ seconds, then disconnect the app. You got right here so you need to have heard about about algorithmic trading. That’s the primary and probably an important step, nicely carried out.

These arbitrage buying and selling methods could be market neutral and used by hedge funds and proprietary merchants extensively. Interactive Brokers regularly updates its buying and selling options. In February 2021, the dealer launched a new model of the app which offers improved information and analysis reader that makes it simple to find the content traders really need to learn. Users of the app can search by subject, symbol or keyword and save their seek for future viewing. The session is perfect for algo trading novices and professionals on the earth of Automated trading with Python. The speaker will begin with transient overview about in style and existing web-based algorithmic buying and selling platforms.

Merchants and buyers are constantly in search of innovative tools and platforms to reinforce their strategies and maximize profits. One such cutting-edge solution is Interactive Brokers (IBKR) Automated Trading, a game-changer that empowers customers to execute trades with precision and efficiency. In this weblog post, we’ll delve into the world of IBKR Automated Buying And Selling, exploring its benefits, features, and how it can revolutionize your buying and selling experience. Information posted on IBKR Campus that’s provided by third-parties does NOT constitute a suggestion that you should contract for the providers of that third celebration. Interactive Brokers is famend for its subtle trading platform, and its Automated Buying And Selling feature takes it to the subsequent stage. This software permits users to automate their trading strategies, enabling hands-free execution based on predefined parameters.

by newadmin | Oct 13, 2023 | FinTech

These could embody small business owners who ship international wire transfers, customers with transactions of average measurement, or companies situated in nations thought-about moderately dangerous. In each space of danger administration, knowing the dangers and the way risky (costly) they may be is the idea for prevention and detection. AML is the same on this respect, but it has the added importance Non-fungible token of being part of the nationwide security/anti terrorist program.

Danger assessments are important for businesses that must adjust to anti-money laundering laws. Not only can they help to guard the economic system from the threat of financial crime, however they can additionally prevent monetary and reputational harm to the organisations concerned. If the danger evaluation finds any of these key threat drivers, another risk drivers specific to a enterprise as present in its companywide AML danger evaluation or has any issues then the company’s anti-money laundering check procedures should be followed. This information explains what risk assessments are, and the way https://www.xcritical.com/ any enterprise can apply them to combat cash laundering while assembly their regulatory compliance obligations.

To successfully mitigate evolving dangers, organisations want a unified danger evaluation technique that brings together insights from all corners of the enterprise. This cohesive method strengthens general security while streamlining operations. As Soon As organizations establish cash laundering risks, they must implement effective risk administration techniques. Rules-based monitoring is one such approach that organizations can use to identify suspicious transactions. This involves creating specific guidelines to help identify suspicious transactions based mostly on pre-defined criteria. AML and fraud threat assessment makes use of pre-determined threat elements for fraud actions and cash laundering to research buyer profiles and decide every customer’s risk stage.

Industry-related Aml Dangers: A Information For Compliance Groups

In that case, they’re ill-equipped to make efficient adjustments and restrict the possibilities of profitable cash laundering, in flip placing themselves vulnerable to income loss, status harm, or in-depth regulatory audits. That’s why First AML now powers thousands of compliance specialists across the globe to reduce the time and value burden of complex and international entity KYC. Source stands out as a number one solution for organisations with complex or worldwide onboarding needs. It supplies streamlined collaboration and ensures uniformity in all AML practices. An unusually massive transaction or unusual exercise that seems to sit outdoors regular industrial activities may characterize a danger issue.

Examples include non-face-to-face enterprise relationships, politically uncovered persons (PEPs), corporations with excessively advanced corporate buildings, or these operating in high-risk geographical areas. This coaching consists of a quantity of modules designed to assist https://talanconpaving.com/european-securities-and-markets-authority/ nations in evaluating their capability to deal with cash laundering and terrorism financing. It guides individuals via identifying dangers and vulnerabilities in various sectors. The course emphasizes the significance of conducting detailed danger assessments to strengthen countermeasures. By inspecting threats in different sectors, members will higher understand and handle dangers.

Who Wants To Complete Aml Threat Assessments?

Risk profiles are evaluations of current firm processes, such as transaction access and safety, buyer onboarding, and authentication/verification checks, to construct a complete profile of potential danger. It identifies the areas where your business is most exposed and ensures your controls are aligned with these dangers. A risk-based method is about tailoring your AML/CTF framework to your corporation. That consists of assessing who your purchasers are via CDD, what services you provide, how those companies are delivered and the place your publicity lies geographically. It’s not about doing every thing for every shopper – it’s about doing the right issues primarily based on risk. In an more and more digital economy, options for digital identification verification and identification proofing are at all times advancing.

- A BSA/AML/CFT customer threat assessment is the method financial establishments use to judge the potential money laundering or terrorist financing threat every customer poses.

- By embedding these methods into your operations, your organisation can keep resilient and competitive in a continuously changing regulatory environment.

- Money laundering is sneaking cash obtained illegally into the monetary system to use it successfully.

- Knowledge graphs and entity decision technologies are additionally improving the accuracy of risk profiling.

- The level (low, medium or high) of that danger and the potential influence on the enterprise is assessed in order that mitigating policies and procedures could be devised and implemented.

- When compliance and business teams don’t collaborate, danger models may be disconnected from real-world customer behavior.

These errors can lead to regulatory fines, reputational injury, or direct financial losses. The framework for threat scoring considers multiple dimensions of danger, including geographical, transactional, product/service, channel, and customer-related elements. Every issue is weighted primarily based on its potential influence on the general danger, allowing organizations to prioritize high-risk prospects and implement targeted controls.

Products

Anti-Money Laundering (AML) regulations for financial institutions—including most cash-handling companies like armored automobile services—are risk-based. That is, the laws acknowledge that the tremendous variation within the regulated companies requires an strategy that adjusts primarily based on the dangers a business truly faces. Corporations ought to implement threat assessments for his or her prospects in accordance with regulators. Companies should pay specific consideration to any high-risk actions when conducting AML risk assessment. Every 12 months, the UK authorities publishes a Nationwide Threat Evaluation aml customer risk assessment (NRA) that outlines the latest tendencies in cash laundering and terrorist financing. This may help when prioritising sure activities as a half of a risk-based method to compliance.

What’s A Risk-based Strategy In Aml Compliance?

Risk classes inside your group could embrace cybersecurity, documentation, customer onboarding, or staff access to critical systems. These classes communicate to broader considerations which will require more substantive efforts to mitigate over time. For instance, a risk profile may establish points with current single-factor authentication requirements for customers and point out the need for added safety. As Quickly As complete, threat profiles present a roadmap for companies to handle key points. The report also identifies a number of the key challenges organizations face in managing AML risk in the digital age. These challenges include the complexity of digital transactions, the shortage of regulation in some jurisdictions and using new applied sciences.

by newadmin | Sep 18, 2023 | FinTech

Breakouts above resistance or beneath help may entice early entries but fail to carry. We hope this article was helpful, and now you’ve a clear understanding of what the liquidity sweep is. (3) The value moved into the BSL zone, but this time, the “fence” or “accordion” pattern didn’t appear. However, it is unlikely that the world above the earlier high was freed from brief sellers’ stop-loss clusters. As proven, the pullback ended when the price entered the SSL zone.

What’s Buy Aspect Liquidity?

When a stock has high volume, it signifies that there are numerous consumers and sellers out there, which makes it simpler for traders to purchase or sell the stock with out considerably affecting its price. On the opposite hand, low-volume shares could additionally be harder to buy or sell, as there may be fewer market individuals and due to this fact https://pointech.sn/2026/01/10/unlocking-wall-streets-dark-data-how-ai-agents-are/ much less liquidity. Buyers, then, will not have to surrender unrealized gains for a fast sale.

This was considered as an indication of a worldwide commerce struggle and a potential threat of stagflation. A liquid market is one with many lively members prepared to purchase and sell at any moment. For example, if a person wants a $1,000 refrigerator, money is the asset that may most easily be used to acquire it. If that individual has no cash however a rare guide assortment that has been appraised at $1,000, they are unlikely to seek out somebody prepared to trade the refrigerator for their collection.

Tighter bid-ask spreads, smoother price actions, and ample buying and selling volume characterize markets with high liquidity. Conversely, low-liquidity markets typically expertise larger volatility and higher buying and selling prices. This concept applies universally across asset classes, from equities to forex and even to alternative markets like cryptocurrencies. As An Alternative, they want to be used as a type of confluence in buying and selling. You can pair them with key ranges similar to Fair Value Gaps (FVG) or Order Blocks (OB) to create a easy buying and selling strategy. Another innovation that was praised through the pandemic was portfolio trading which entails bundling a quantity of bonds into a single bundle commerce.

How Liquidity Supports Market Effectivity

An investor might potentially lose all or greater than the initial funding. Risk capital is cash that might be lost with out jeopardizing ones’ financial security or life style buy side liquidity. Solely risk capital must be used for buying and selling and only those with enough danger capital ought to think about trading.

- These key ranges, usually at buyside liquidity and sellside liquidity, are areas the place retail traders generally place cease losses for his or her positions.

- Establishments typically manipulate liquidity by concentrating on areas with vital stop-loss orders or pending orders to create synthetic value strikes.

- Unlike counting on fundamental indicators, ICT focuses on understanding how institutions drive costs.

- Market knowledge is offered by CBOE, CME Group, BarChart, CoinAPI.

- For bullish liquidity grabs, or grabs at sellside liquidity, the massive wick signifies lots of buyers stepped into the market.

- Whereas false alerts can problem short-term methods, they also reveal valuable information about market conditions.

Context Over Isolated Signals

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his personal monetary advisory firm in 2018. Thomas’ expertise gives him expertise in a wide range of areas including investments, retirement, insurance coverage, and monetary planning. ICT ideas by Michael J. Huddleston are unique and will not coincide with other buying and selling methodologies.

Nevertheless, this is doubtless an oversimplified view of market trading. With that in mind https://www.xcritical.com/, we now flip to the important thing idea of this article—a liquidity sweep. Ir refers to the value getting into a liquidity zone and subsequently reversing.

How Merchants Interpret And Handle False Signals

The inventory market, on the opposite hand, is characterised by higher market liquidity. Hypothetical efficiency outcomes have many inherent limitations, a few of which are described under. One of the restrictions of hypothetical performance outcomes is that they are usually prepared with the benefit of hindsight. In addition, hypothetical buying and selling doesn’t contain financial risk, and no hypothetical buying and selling document can completely account for the impact of economic danger of actual buying and selling. For example, the power to withstand Initial coin offering losses or to adhere to a selected buying and selling program regardless of buying and selling losses are material points which may also adversely affect actual trading results. Fairness, Futures, Crypto and forex trading accommodates substantial threat and isn’t for each investor.

Recent Comments