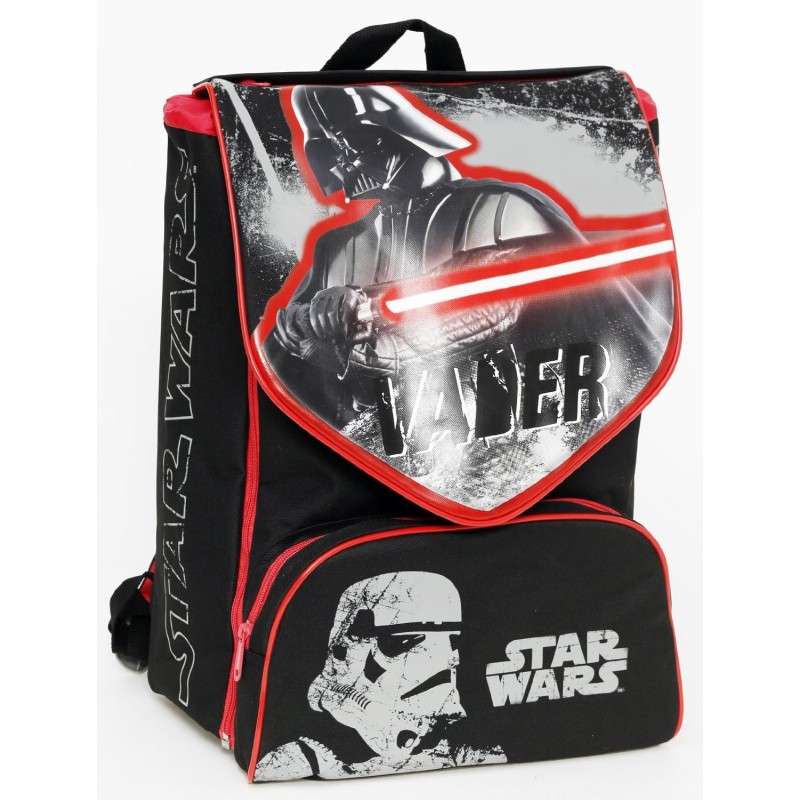

STAR WARS Zaino con licenza ufficiale per ragazzi, in poliestere resistente, con cinghie regolabili, 43,2 x 30,5 x 15,2 cm (altezza x larghezza x profondità), Logo 4, Large, Star Wars Zaino : Amazon.it: Moda

Auguri Preziosi TG902000 Star Wars Rogue One Bustina Ovale, Collezione 2017/18 : Amazon.it: Giochi e giocattoli

HAMIQI Zaino con logo dell'esercito ribelle di Star Wars Zaino da viaggio per esterni Zaino per studenti Zaino per laptop (Arancia) : Amazon.it: Moda

HAMIQI Zaino con logo dell'esercito ribelle di Star Wars Zaino da viaggio per esterni Zaino per studenti Zaino per laptop (Arancia) : Amazon.it: Moda

HAMIQI Zaino con logo dell'esercito ribelle di Star Wars Zaino da viaggio per esterni Zaino per studenti Zaino per laptop (Arancia) : Amazon.it: Moda

Auguri Preziosi TG904000 Star Wars Rogue One Zaino Estensibile Con Gadget, Collezione 2017/18 : Amazon.it: Moda

HAMIQI Zaino con logo dell'esercito ribelle di Star Wars Zaino da viaggio per esterni Zaino per studenti Zaino per laptop (Arancia) : Amazon.it: Moda

Giochi Preziosi - Star Wars Zaino Trolley Scuola Estensibile con Spada Laser in Omaggio | Tracciamento dei

LibroLandia.it il negozio online | Giochi | Carnevale | Scuola | GIOCHI PREZIOSI TW900000 ZAINO ESTENS MULTI GADGET STAR WARS

HAMIQI Zaino con logo dell'esercito ribelle di Star Wars Zaino da viaggio per esterni Zaino per studenti Zaino per laptop (Arancia) : Amazon.it: Moda